Improving payment integrity

Background

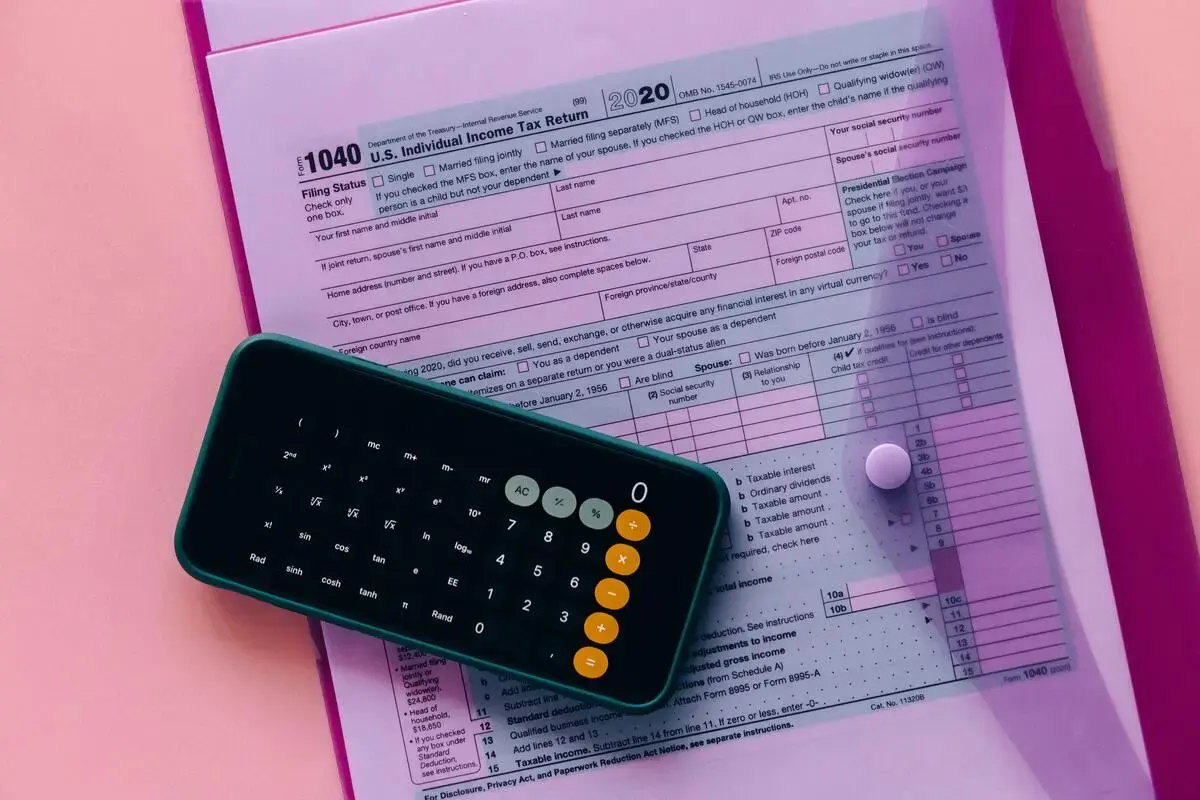

Payment integrity demonstrates stewardship of taxpayer dollars by reducing monetary loss and making payments correctly the first time and is a top priority across the executive and legislative branches. Improper payments, which constitute any “payment that should not have been made or that was made in an incorrect amount under statutory, contractual, administrative, or other legally applicable requirement,” totaled approximately $206 billion across all government agencies in FY 2020.

Portfolio

OES has collaborated with the Social Security Administration (SSA), U.S. Department of Agriculture (USDA), the U.S. General Services Administration (GSA), the Internal Revenue Service (IRS), and the U.S. Chief Financial Officers Council to help agencies build and use evidence to improve payment integrity and reduce improper payments.

As part of this portfolio, OES has evaluated applications of insights from the social and behavioral sciences to the modification of forms, changes to how and when agencies request information, and changes to communications describing key actions and recommendations. OES also developed a guide to help agencies explore whether a “behavioral insights” approach is a good fit for their programs, identify which interventions might work, and implement those program changes.