Encouraging account transfers by securities holders

Treasury building front

What was the challenge?

The U.S. Department of the Treasury’s Legacy Treasury Direct (LTD) program allowed investors to purchase marketable securities directly from Treasury, via mail, fax, and phone. LTD was phased out starting in 2011, before being decommissioned in late 2014. Before and during the phase out, Treasury sent several letters to LTD account holders encouraging them to transition their accounts to TreasuryDirect, an online system.

What was the program change?

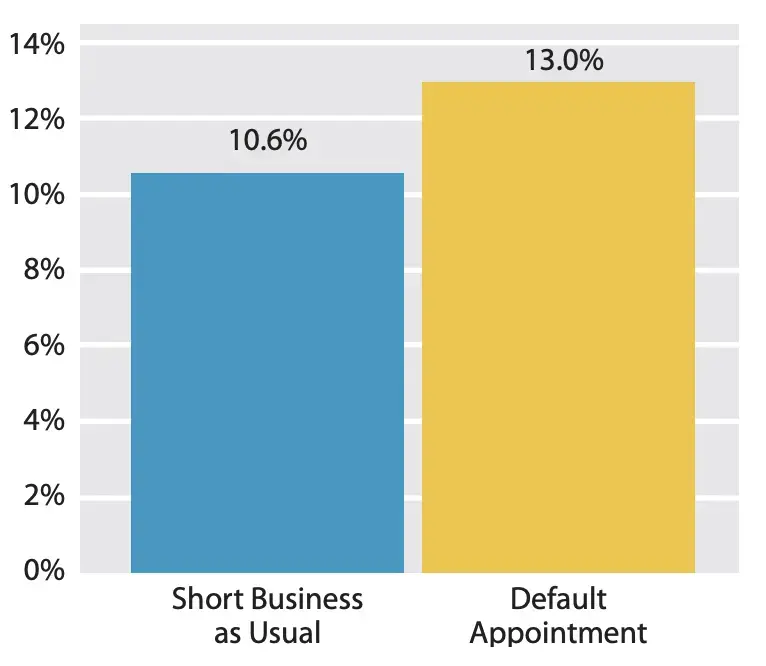

We developed two letters for LTD account holders applying the research insight that individuals are more likely to follow through on plans that identify specific moments of action, such as appointments.

How did the evaluation work?

33,500 remaining LTD account holders received letters mailed over 16 business days.

What was the impact?

Creating a moment of action to call in resulted in more investors calling in to discuss account options with Treasury Representatives - the letter including the appointment resulted in a 2.37% increase in call-in rates. However, the mailings did not result in significant customer account changes from LTD to TreasuryDirect.