Prompting decisions on retirement savings

Person holding a document

What was the challenge?

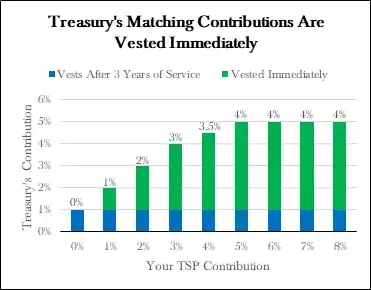

The federal government operates a savings program for its employees known as the Thrift Savings Plan (TSP). New employees are automatically enrolled in the plan at a contribution rate of 3 percent, and nearly 90 percent of civilian employees participate in the plan. However, civilian employees who contribute to TSP receive matching employer contributions up to a maximum of 5 percent. Nearly 1 in 3 new employees at the U.S. Department of the Treasury (Treasury) contributed less than 5 percent in FY 2015, therefore sacrificing both overall compensation and added retirement security.

What was the program change?

The success of prompted choices in private sector workplace savings—where employees are encouraged to actively choose whether to contribute and how much — suggests that many new employees might contribute more if they were encouraged to make a choice. A suite of new materials at three Treasury bureaus - including information on matching contributions, TSP info on new employee checklists, and revised onboarding presentation materials - encouraged new employees to consider contributing at least 5%.

How did the evaluation work?

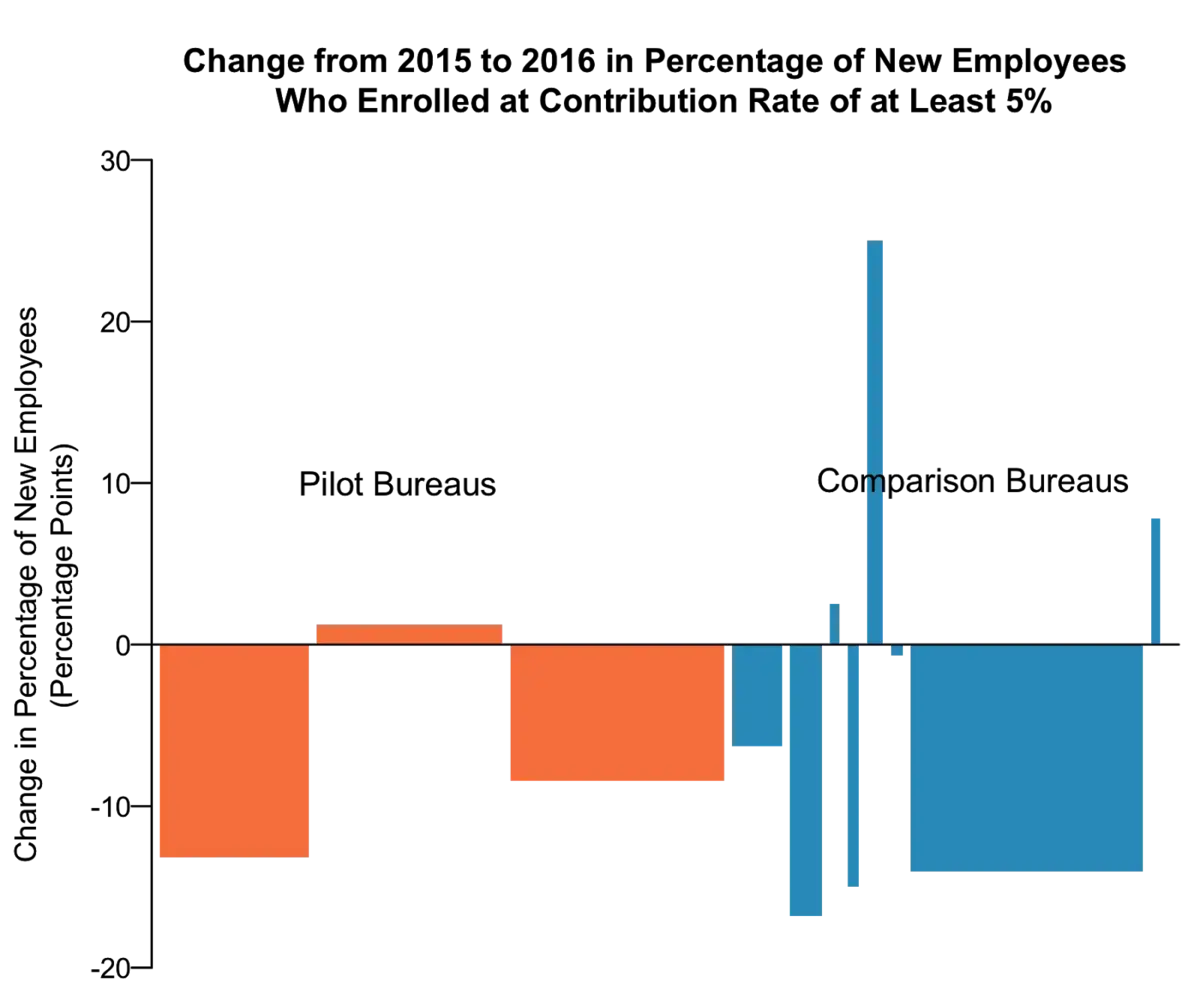

Orientation logistics made random assignment infeasible. For the purpose of estimating impacts of the treatment at pilot bureaus, TSP contribution rates were collected at pilot bureaus in the same time period in the year preceding the pilot period, and from eight other Treasury bureaus during the pilot and pre-pilot periods.

What was the impact?

While the informational materials tested by Treasury in this pilot project did not result in a statistically significant change (using Difference-in-differences analysis) in the percentage of new employees contributing 5% or more, Treasury was able to rapidly evaluate the impact of this intervention, and the results can inform future efforts to promote contribution to TSP.