Increasing IDR applications among eligible student loan borrowers - scale up

Student graduation

What was the challenge?

Student loan borrowers have over $1.26 trillion dollars in outstanding federal student loan debt. Income-driven repayment (IDR) plans can help Americans manage this debt by limiting their monthly payments to a percentage of their discretionary income and providing loan forgiveness. Despite these benefits, fewer than 15% of eligible student loan borrowers are in IDR repayment plans.

What was the program change?

We worked with The U.S. Department of Education’s (ED) Office of Federal Student Aid (FSA) to design and test the application of proven insights in updated emails sent to a number of different borrower groups eligible for IDR plans.

How did the evaluation work?

3,036,691 borrowers were randomly selected to receive either the most effective message from the Targeted Messages pilot, or no email.

What was the impact?

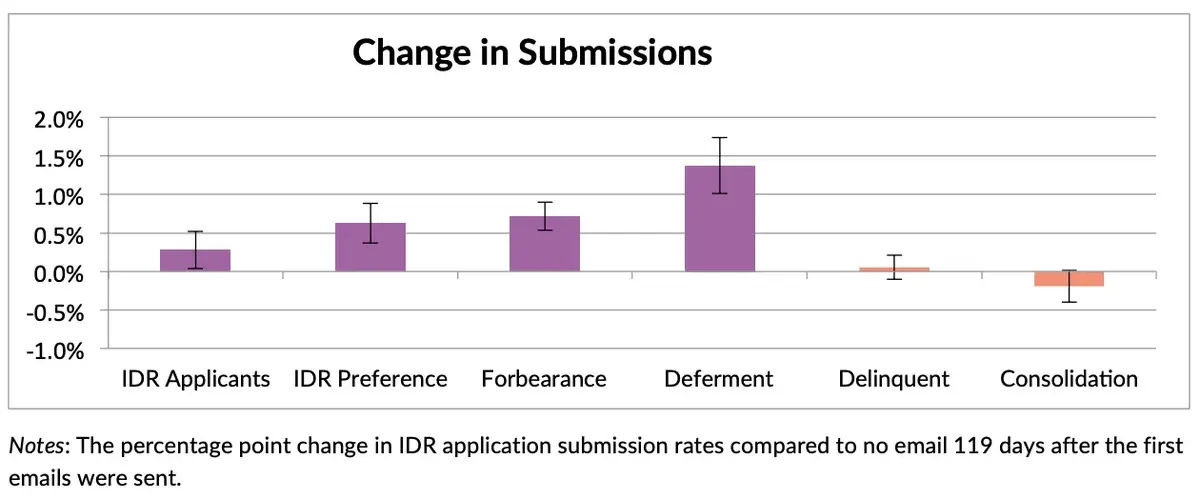

On average, sending an email increased submissions by 0.35 percentage points over the control submission rate. The campaign resulted in more than 6,000 additional borrowers signing up for IDR plans, shifting approximately $300 million of federal student loans into income-driven repayment plans.