Who receives access to small business relief? A simulation-based approach

Front of shops in a street

What was the challenge?

In the wake of the COVID‐19 crisis, local governments rapidly distributed emergency grants and loans to small businesses. Many local agencies used a mix of three primary methods to distribute funds when the demand for funding exceeded the amount of funding available: first‐come, first‐served, lotteries, and points systems. The choice of method was often based in part on the desire to equitably support the businesses that have historically been less able to access financing, including those with owners who are women, Black or Hispanic, or low-income, as well as businesses located in areas with high concentrations of underserved households. The aim of the present project was to investigate the potential impact of those approaches on award rates for underserved businesses.

What did we do?

We pooled and analyzed business-level data on all applicants to small business relief programs in three cities, which accepted applications and disbursed funds between March 2020 and February 2021. We investigated two sets of equity-related questions. First was descriptive equity: to what extent were applicant businesses located in underserved communities and did they have underserved owners?

Second was counterfactual equity—or how businesses from different groups and geographic areas would fare under different methods cities could use to prioritize businesses for funding. This method takes real applications and asks “what if” funding had been allocated with a different approach, such as giving funding to those that applied earliest, or using a lottery, or by assigning points based on certain characteristics.

We compare the portion of funding that would be awarded to applicants from businesses owned by women, businesses with other types of underserved owners (e.g., minority-owned), and businesses located in low-to-moderate income areas, under 10 different allocation methods including approaches that do or do not explicitly prioritize businesses from historically underserved groups.

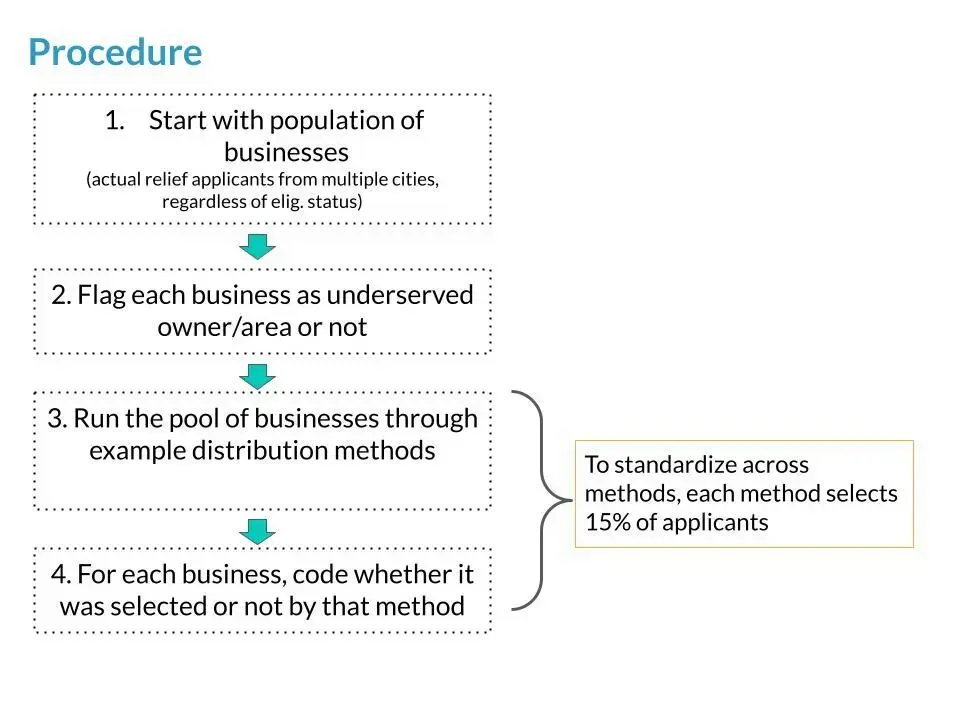

Figure 1: Here, we show the procedure for simulating the impact of allocation methods on outcomes for underserved businesses. We started with business-level application data (N ~ 16,000), compare ten allocation methods (different variations of first-come first-served, lotteries, and points systems), and examine the impact on award rates for underserved businesses.

What did we learn?

Analyses of descriptive equity show the importance of precise measurement of underserved, including defining the unit of analysis (individuals versus areas) and whether being underserved comes from possessing any underserved attributes versus multiple. Simulations showed that both basic first-come, first-served methods and points systems that do not explicitly prioritize businesses from historically underserved groups disadvantage those businesses.

However, weighted lotteries and set asides within first-come, first-served methods offer a consistent way to increase the funding going to historically underserved groups. A better understanding of these effects of allocation methods on the amount of funding flowing to historically underserved businesses will allow government programs to make informed decisions about the criteria they use to determine eligibility and prioritization for relief funds.

Verify the upload date of our Analysis Plan on GitHub.